Registered Education Savings Plan

Registered Education Savings Plan

Benefits of an RESP

Open an RESP for no charge and pay no annual administration fees

Tax Sheltered Growth

Earnings within an RESP are not taxed. When the funds are taken out for education, withdrawals are taxed in the student’s hands, often resulting in little or no tax.

Get Government Contributions

Grow your savings faster with the Canada Education Savings Grant (CESG), Canada Learning Bond (CLB), and other government incentives. See RESP Grants and Bonds.

Built-In Flexibility

If the child doesn’t pursue post-secondary education, you may be able to choose a new beneficiary. Or, if he or she wants to travel first, you have 35 years to use the funds.

How to Grow Your RESP Savings Faster

Invest Regularly

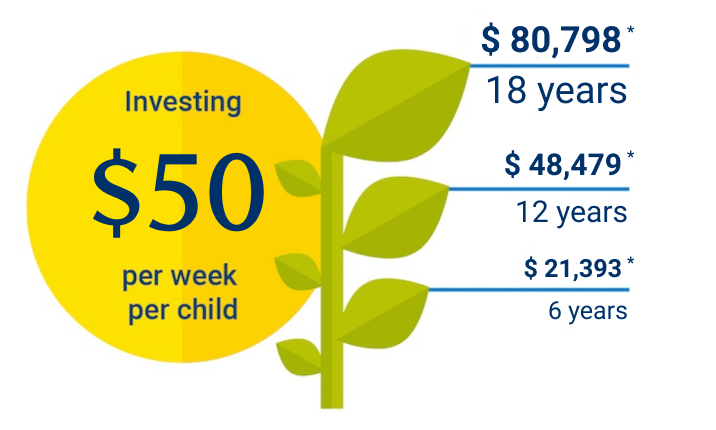

See how contributing $50 per week in an RESP adds up quickly when supplemented by the federal and provincial incentives.

Automate Your Savings

With a regular, pre-authorized contribution plan you save without even thinking about it!

- Start with as little as $50 per week

- Contribute weekly, bi-weekly, monthly—you choose

- Set it and forget it—contributions are automatically debited from your bank account (change, pause or stop at any time)

Make the Most of Your RESP Options

“Did you know, there’s more than one kind of RESP?”

Fees, Contribution Rules, & More

- RESP Rules and Contribution Limits

To take advantage of the benefits of an RESP, there are a few rules you’ll want to know about.

- RESP Grants and Bonds

Discover the various government incentives and supplements that are available with RESPs.

- RESP Fees

There could be some management fees depending on the RESP plan.

Need RESP answers now?

Call +1 438 701 3770 to speak to our advisors right away, or book some time with them.

+1 855 410 9006 (Toll-Free for Outside Canada)

How to Register an Education Savings Plan in Canada

A child’s education is one of the most valuable investments a parent can make. With tuition fees and living expenses on the rise, planning ahead has never been more important. At Unity Financial Services, we help families open and manage Registered Education Savings Plans (RESPs) in Canada, enabling them to secure their children’s future without financial stress.

What Is an RESP?

A Registered Education Savings Plan (RESP) in Canada is a government-supported savings account designed to help families save for their children’s post-secondary education. Contributions grow tax-deferred, and the government adds extra funds through grants to boost your savings. When it’s time for your child to attend college, university, or vocational training, withdrawals are taxed at the student’s lower income level, making it one of the most innovative ways to save for education.

How an RESP Works

- Contributions – Parents, grandparents, or guardians can contribute up to a lifetime maximum of $50,000 per child.

- Tax-Deferred Growth – Earnings on contributions grow tax-free until withdrawn.

- Government Grants – The Canada Education Savings Grant (CESG) matches contributions up to 20% annually (to a maximum of $500 per year). Lower-income families may also qualify for the Canada Learning Bond (CLB).

- Withdrawals – When used for education, withdrawals are taxed in the student’s name, often resulting in little to no tax due.

Benefits of a Registered Education Savings Plan in Canada

- Free Government Money – Take advantage of grants and bonds to boost your contributions.

- Flexible Use – Funds can be used for universities, colleges, trade schools, and other eligible programs in Canada or abroad.

- Long-Term Growth – Invest in mutual funds, ETFs, or other vehicles to grow savings over time.

- Financial Security – Reduce or eliminate the need for student loans and debt.

- Family Contributions – Anyone (parents, grandparents, relatives) can contribute to a child’s RESP.

How Unity FS Helps

Opening an RESP is simple, but maximizing it requires planning. At Unity FS, our advisors:

- Explain eligibility rules and contribution limits.

- Help you apply for the CESG and CLB to maximize government benefits.

- Provide investment strategies tailored to your child’s timeline and your risk tolerance.

- Monitor your RESP year after year to ensure it stays on track.

- Guide you when it’s time to make withdrawals for education.

Who Should Open an RESP?

A registered education savings plan in Canada is ideal for:

- Parents who want to secure their child’s educational future.

- Grandparents looking to contribute to their grandchild’s success.

- Guardians or Relatives interested in helping with long-term educational savings.

- Families of All Income levels, with grants and bonds, RESP savings are accessible to everyone.

Why Unity FS?

At Unity Financial Services, education should never be out of reach due to financial constraints. We provide personalized RESP advice and ongoing support to make sure your contributions go further. With access to a range of investment products and bilingual support, we make RESP planning simple and effective.

When you work with Unity FS, you get:

- Step-by-step guidance on RESP setup.

- Professional investment advice.

- Affordable, transparent service.

- A trusted partner in your child’s financial future.

Invest in Your Child’s Future Today

Don’t wait until tuition bills arrive. Start planning now with a Registered Education Savings Plan (RESP) in Canada. With Unity Financial Services, you’ll have expert guidance, government support, and a plan that grows alongside your child.

Contact Unity FS today to open an RESP and give your child the gift of education.

RESP FAQs

Explore top RESP questions.

There is no charge to open an RESP account

You can contribute any amount to an RESP, subject to a lifetime limit of $50,000 per beneficiary. You can contribute to an RESP for up to 31 years, and the plan can remain open for a maximum of 35 years.

Yes! An RESP Gift Cheque can be used to invest in a child’s future. RESP Gift Cheques can be deposited into new or existing RESP accounts.

Once an RESP beneficiary is enrolled in a qualifying post-secondary education or training program, the accumulated income, grants and bonds within the RESP can be paid out to the student as an Educational Assistance Payment (EAP) at the discretion of the subscriber (person who opened the RESP).

An RESP beneficiary must claim all Educational Assistance Payments (EAPs)—as income on his or her tax return in the year that they are received. Usually, this results in little or no tax since students tend to be in the lowest tax bracket and can claim tax credits for the personal amount and education-related expenses. Contributions can be withdrawn tax-free.

An RESP can hold a variety of investments, including Guaranteed Investment Certificates (GICs), ETFs, Index Funds, Segregated funds, portfolio solutions and savings deposits. You can also hold bonds.

You can contribute to an existing RESP account online through Online Client Portal or the Mobile app.

You can contact our advisors for instructions.Best RESP plans in Canada