Day: 8 September 2025

-

2025 CRA Tax Changes: What Canadians Need to Know This Tax Season

Tax season 2025 is here — and with it, the Canada Revenue Agency (CRA) has introduced several important updates that affect both individuals and businesses. Whether you’re filing for the first time or you’re an experienced taxpayer, understanding these changes can help you maximize your refund, reduce stress, and avoid costly penalties. At Unity Financial…

-

What are Welcome to Canada Benefits?: Essential Federal Benefits for Newcomers

Settling into a new country can be challenging—but Canada offers meaningful support for newcomers from day one. Whether you’re a permanent resident, protected person, or temporary resident (such as a student or worker), there are numerous federal benefits and credits designed to ease your transition and help your family thrive. In June 2025, the Canada…

-

How to Make a CRA Account?

If you are a Canadian taxpayer, having access to your CRA (Canada Revenue Agency) My Account is almost essential. Whether you’re checking your RRSP deduction limit, tracking your tax return status, managing benefit payments like the Canada Child Benefit (CCB), or accessing your T4 slips online — the CRA account makes all of it possible…

-

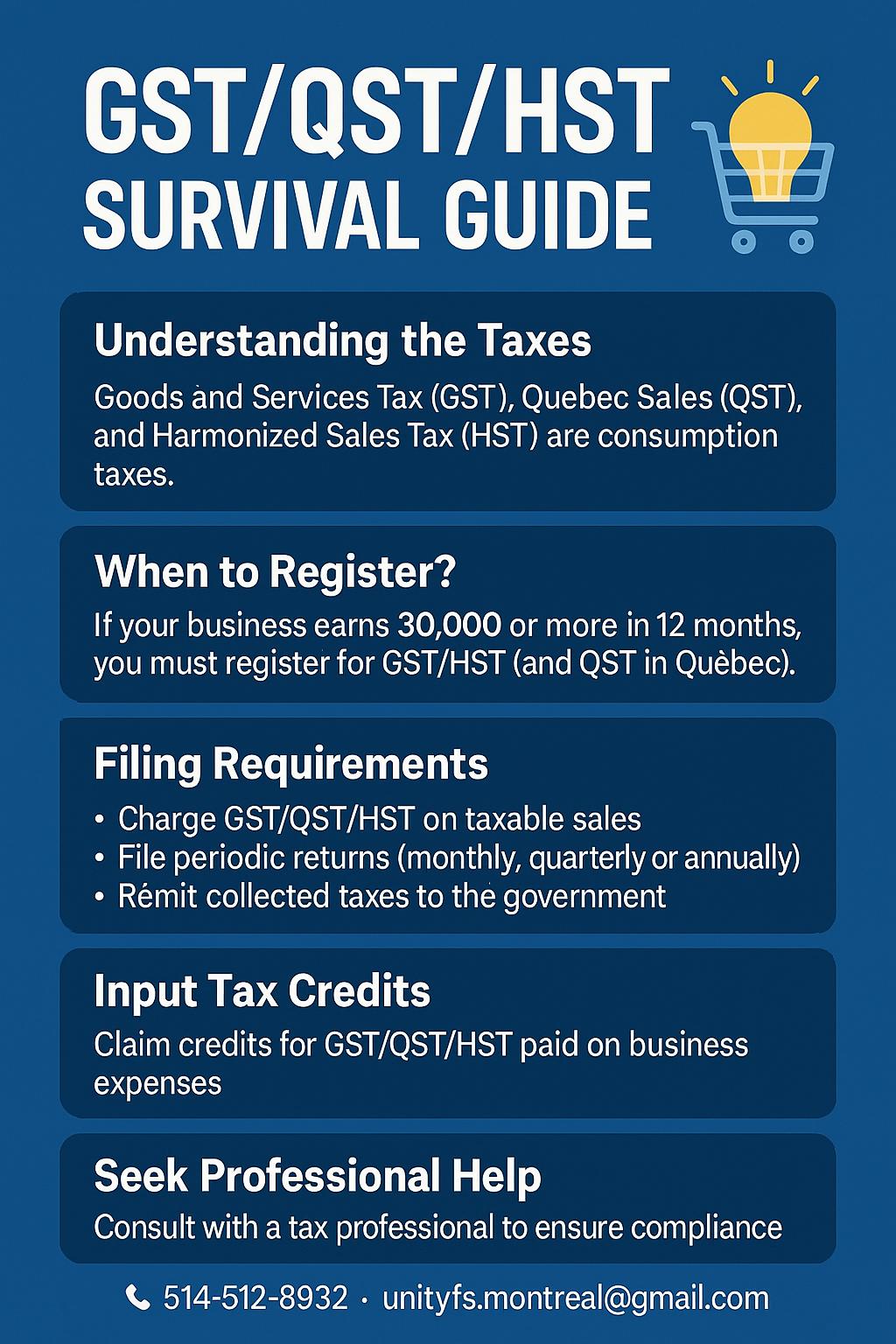

GST/QST/HST Survival Guide for Small Businesses

Running a small business in Canada is exciting — but it also comes with responsibilities, especially when it comes to sales taxes. Between GST (Goods and Services Tax), QST (Québec Sales Tax), and HST (Harmonized Sales Tax), things can get confusing quickly. This simple guide will help you stay compliant, avoid penalties, and keep your…