Category: Uncategorized

-

How to Make a CRA Account?

If you are a Canadian taxpayer, having access to your CRA (Canada Revenue Agency) My Account is almost essential. Whether you’re checking your RRSP deduction limit, tracking your tax return status, managing benefit payments like the Canada Child Benefit (CCB), or accessing your T4 slips online — the CRA account makes all of it possible…

-

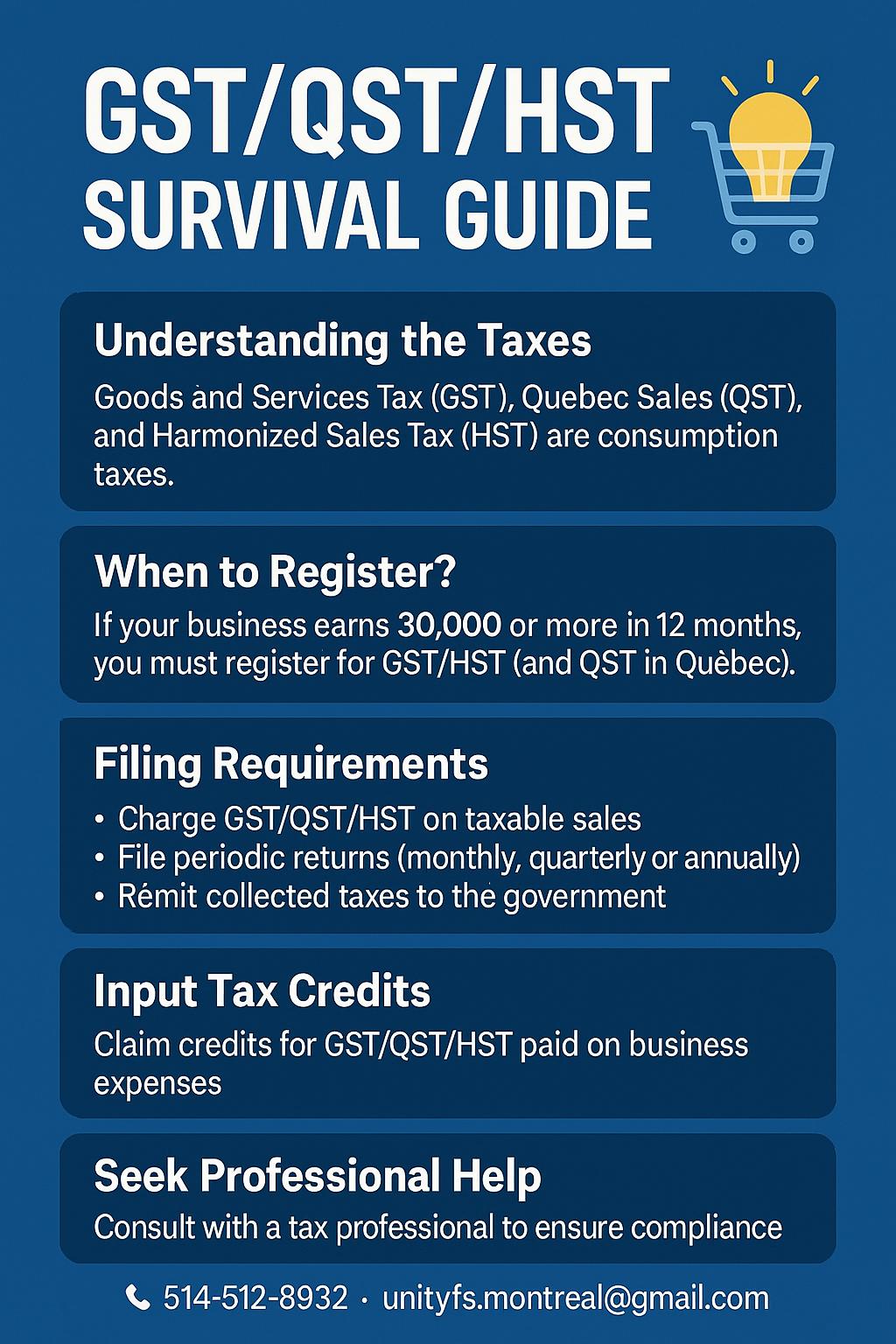

GST/QST/HST Survival Guide for Small Businesses

Running a small business in Canada is exciting — but it also comes with responsibilities, especially when it comes to sales taxes. Between GST (Goods and Services Tax), QST (Québec Sales Tax), and HST (Harmonized Sales Tax), things can get confusing quickly. This simple guide will help you stay compliant, avoid penalties, and keep your…

-

Enhanced Trust Reporting Requirements

Blog Details Enhanced Trust Reporting Requirements As of December 31, 2023, new reporting requirements for trusts have taken effect in Canada. All trusts, unless specific conditions are met, must file a T3 return for tax years ending after December 30, 2023. Many trusts, including bare trusts, will need to file for the first time. The…

-

Here Are The Important Dates You Need To Know Regarding Recent Changes

Blog Details Here Are The Important Dates You Need To Know Regarding Recent Changes Individuals : Federal & Quebec Individuals : Federal & QuebecFiling Deadline: April 30, 2024Payment Due Date: April 30, 2024Self-employedFiling Deadline: June 15, 2024Payment Due Date: June 15, 2024Trusts with a tax year end of Dec 31, 2021Filing Deadline: March 30, 2024Payment…

-

Tax Consequences of New House and Condominium Assignment Sales in Canada

Blog Details Tax Consequences of New House and Condominium Assignment Sales in Canada In the dynamic landscape of Canadian real estate, Assignment Sales have become increasingly prevalent. These transactions involve a purchaser (known as the assignor) who, having previously entered into an agreement of purchase and sale with a builder for a new house or…

-

RRSP contribution limit and deadline

Blog Details RRSP contribution limit and deadline We all know what an RRSP is. RRSP is a banking savings product which allows the taxpayer to exclude their annual RRSP contributions from their income for two specific purposes. Firstly, the annual RRSP contribution amounts are deducted from the income therefore the taxpayer will not be taxed…

-

Tax Implications of Ontario Student Assistance Program (OSAP)

Blog Details Tax Implications of Ontario Student Assistance Program (OSAP) The Ontario Student Assistance Program (OSAP) provides crucial financial support to students pursuing post-secondary education in Ontario. Whether you’re navigating the labyrinth of grants and loans while still in school or dealing with repayment after graduation, understanding the tax implications of OSAP is essential. In…

-

To Salary or To Contract, That Is the Question!

Blog Details To Salary or To Contract, That Is the Question! The decision to hire salaried employees or contractors is a crucial one for corporations in Canada. While both types of workers have their advantages and disadvantages, the choice ultimately depends on the specific needs of the company. Salaried employees are typically hired for long-term…